When it comes to artificial intelligence (AI), the “Magnificent Seven” stocks probably come to mind. The moniker includes the majority of megacap companies leading the AI revolution: Apple, Alphabet, Microsoft, Nvidia, Tesla, Meta Platforms, and Amazon.

One company that might be getting overlooked in the AI arms race is Palantir (NYSE: PLTR). While the data analytics company is best known for its close ties to the U.S. military and its allies, Palantir is far more than a government contractor. It has a growing presence in the private sector and works with customers across a variety of markets.

Yet despite this, the stock is trading roughly 50% below its all-time highs. And while some on Wall Street remain skeptical of Palantir’s long-term potential, one notable investor in particular has been buying the dip. The funds of ARK Invest CEO Cathie Wood have ratcheted up their buying of Palantir as of late.

For the trading period between Dec. 6 and Dec. 15, Ark funds purchased 1.7 million shares in Palantir stock across three exchange-traded funds (ETFs). While the company represents only 1.2% of Ark’s combined portfolio, it has a bigger position than most of the Magnificent Seven stocks.

With the stock trading for just $18 per share as of this writing, now is a terrific time to assess Palantir’s prospects.

What’s going on?

A recent bearish analyst report from investment bank William Blair spurred a sell-off in Palantir stock that wiped nearly $4 billion off its market capitalization.

William Blair analyst Louie DiPalma expressed concerns about a contract that Palantir has with the U.S. Army, suggesting that the upcoming renewal of that contract may be for less than the original deal’s value. As of this morning, Dec. 15, Palantir helped curtail those worries as the Army contract renewed for an additional year. While the initial deal was a multiyear contract, long-term investors shouldn’t get hung up on the extension being for only one year. Rather, there are several reasons why investors should believe the sell-off was overblown and could be a buying opportunity.

Demand for AI-powered services is off the charts

It’s important to keep in mind that the Army contract is just one deal. The advancements Palantir has made in artificial intelligence have led to a surge in demand for its services that I think is being overlooked. Earlier this year, it released a new product called the Palantir Artificial Intelligence Platform (AIP), which uses generative AI and large language models (LLMs) to help solve complex operational challenges.

While this may sound similar to the solutions offered by some of the big tech giants, Palantir may have an edge thanks to its creative lead generation strategy. The company has been hosting immersive seminars it calls “boot camps,” at which prospective customers can test out its software platforms. The goal of these events is to quickly identify use cases for its services, giving Palantir an opportunity to sell products and expand sales to customers as time goes on.

While the boot camps are still a new innovation for the company, demand to attend them is off the charts. During Palantir’s third-quarter earnings call, Chief Technoloyg Officer Shyam Sankar said, “we’re running more boot camps per month than we had U.S. commercial pilots all last year.” The company had conducted boot camps for 200 organizations through November.

These boot camps represent a way for Palantir to potentially capture a piece of the growing AI market for little cost, and perhaps shorten its sales cycle significantly. As companies attend the seminars and convert into paying customers, Palantir has an opportunity to cross-sell and upsell products at a faster rate. In theory, this should help it accelerate its revenue growth while keeping its spending on sales, marketing, and customer retention low.

Is Palantir’s valuation justified?

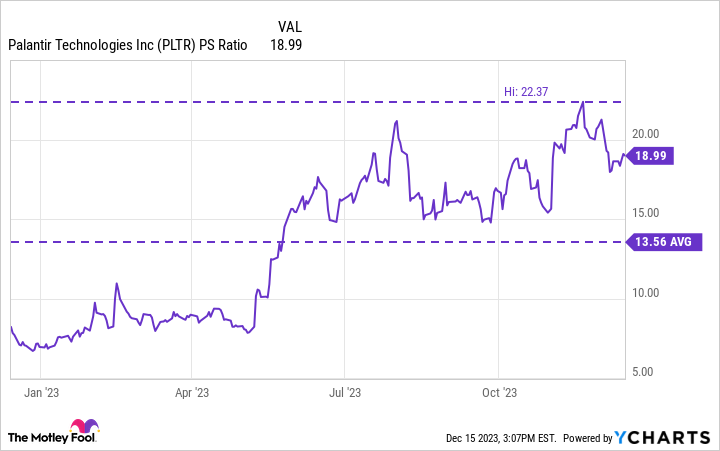

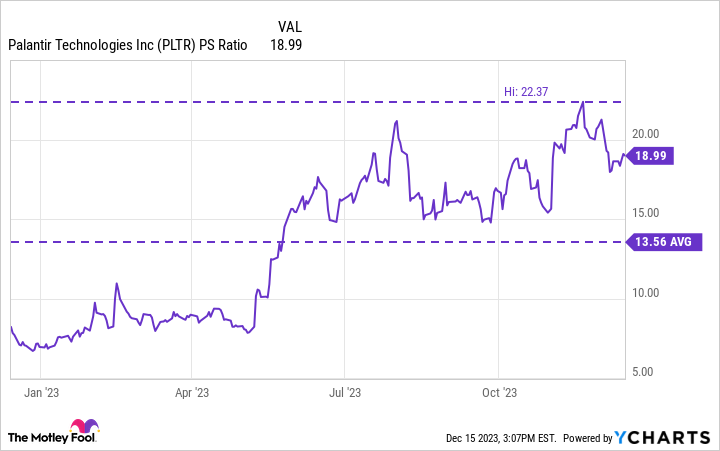

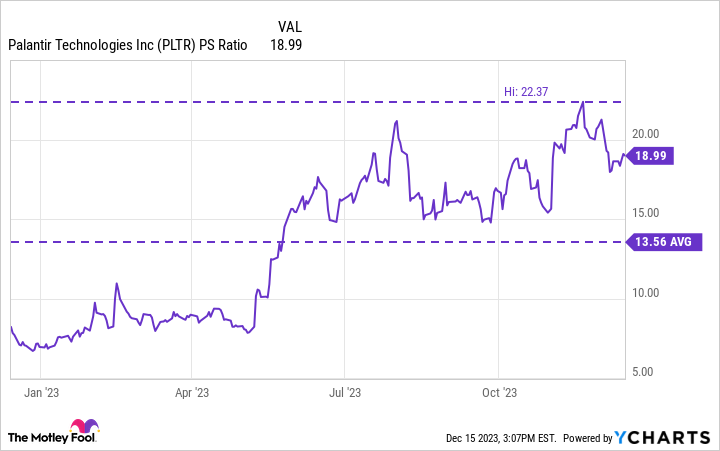

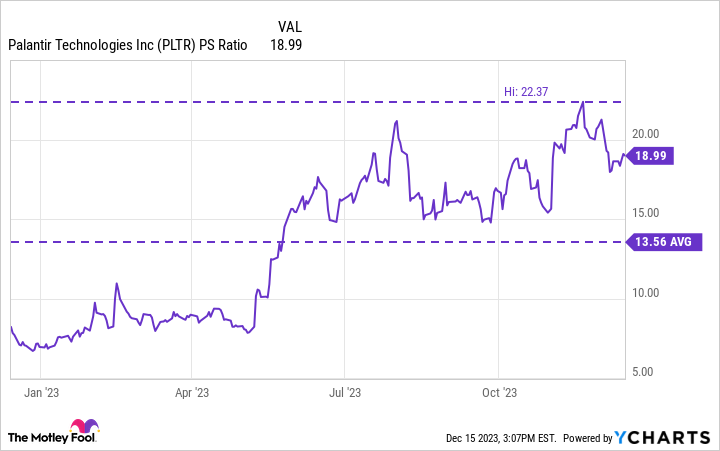

The chart below shows that Palantir’s price-to-sales (P/S) ratio of 19 is currently well above its one-year average and inching toward prior highs. While this may seem a little rich, I see Palantir as deserving of a premium.

Unlike many of its software-as-a-service (SaaS) cohorts, Palantir is already profitable on a GAAP (generally accepted accounting principles) basis. In fact, given its consistent profits, Palantir is eligible for inclusion in the S&P 500, a huge milestone for any company. The thing long-term investors should be considering here is the pace at which Palantir’s offerings are being adopted and deployed.

For instance, during Q3 Palantir nearly tripled its AIP users. According to management, since its launch five months ago, 300 unique organizations have deployed AIP. While it’s clear that the boot camps are driving interest in Palantir’s products, investors should keep in mind that these prospects are contributing little to no revenue for Palantir today. Rather, it’s the rising interest in attending and testing out AIP that could serve as a proxy of what Palantir’s future could look like. It’s these long-term secular tailwinds that attract investors like Wood, and underscore her conviction to buy when the stock falls off a cliff.

In the long run, Palantir’s ability to accelerate revenue growth while also sustaining profits looks achievable. As the stock experiences some pronounced selling activity, now looks like an incredible opportunity to begin dollar-cost averaging into a long-term position for this AI disrupter.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Datadog, Meta Platforms, Microsoft, MongoDB, Nvidia, Palantir Technologies, ServiceNow, Snowflake, and Tesla. The Motley Fool has a disclosure policy.

Cathie Wood Just Made a Big Purchase of This Artificial Intelligence (AI) Stock. You Could Follow Her Lead for Less Than $20 per Share. was originally published by The Motley Fool